ALL IN THE NUMBERS

Airfare fluctuation, booking lead times, shifting travel volumes and NDC adoption are all laid bare in the corporate travel data set out below

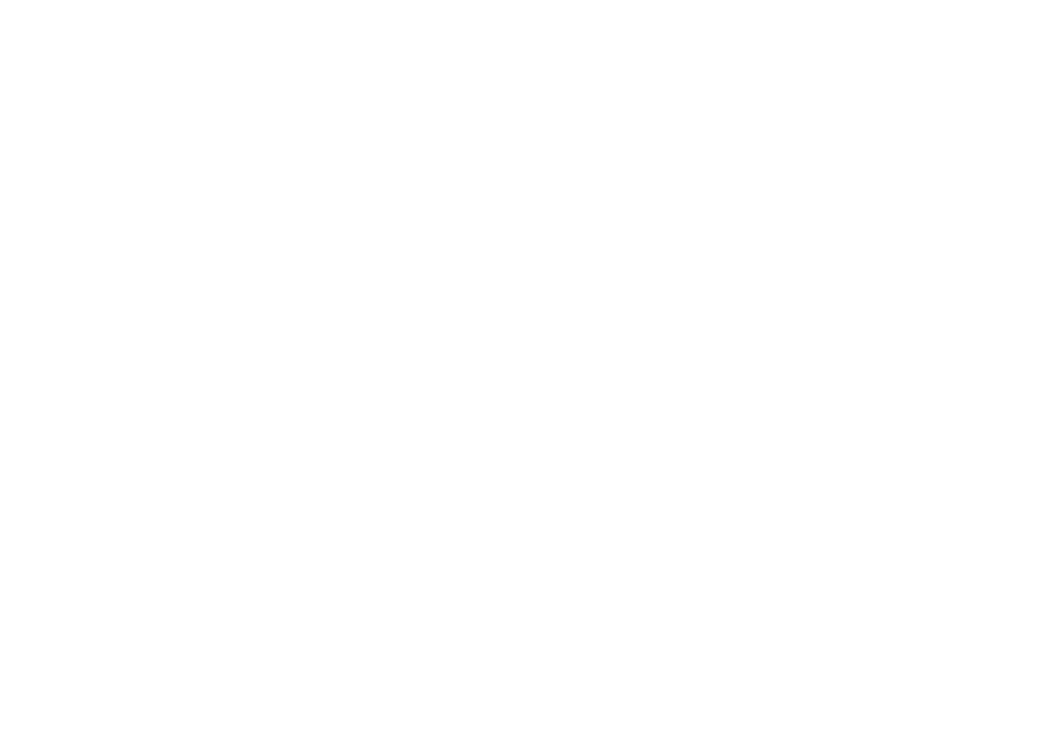

Booked fares fluctuation

The average airfare booked through Concur Travel in Europe fluctuated through 2024, from $853 at its lowest in June and peaking in December at $1,017. Data from eight key European markets shows average booked fares were at their lowest in Italy and Spain and their highest in the UK, at almost twice the average value. This could be for several reasons, including the booking of more long-haul fares from the UK, more generous premium class policies, the UK’s industry mix – with a strong presence in finance, legal and consultancy sectors – and/or the UK’s higher base airfares.

(Source: SAP Concur)

(Source: SAP Concur)

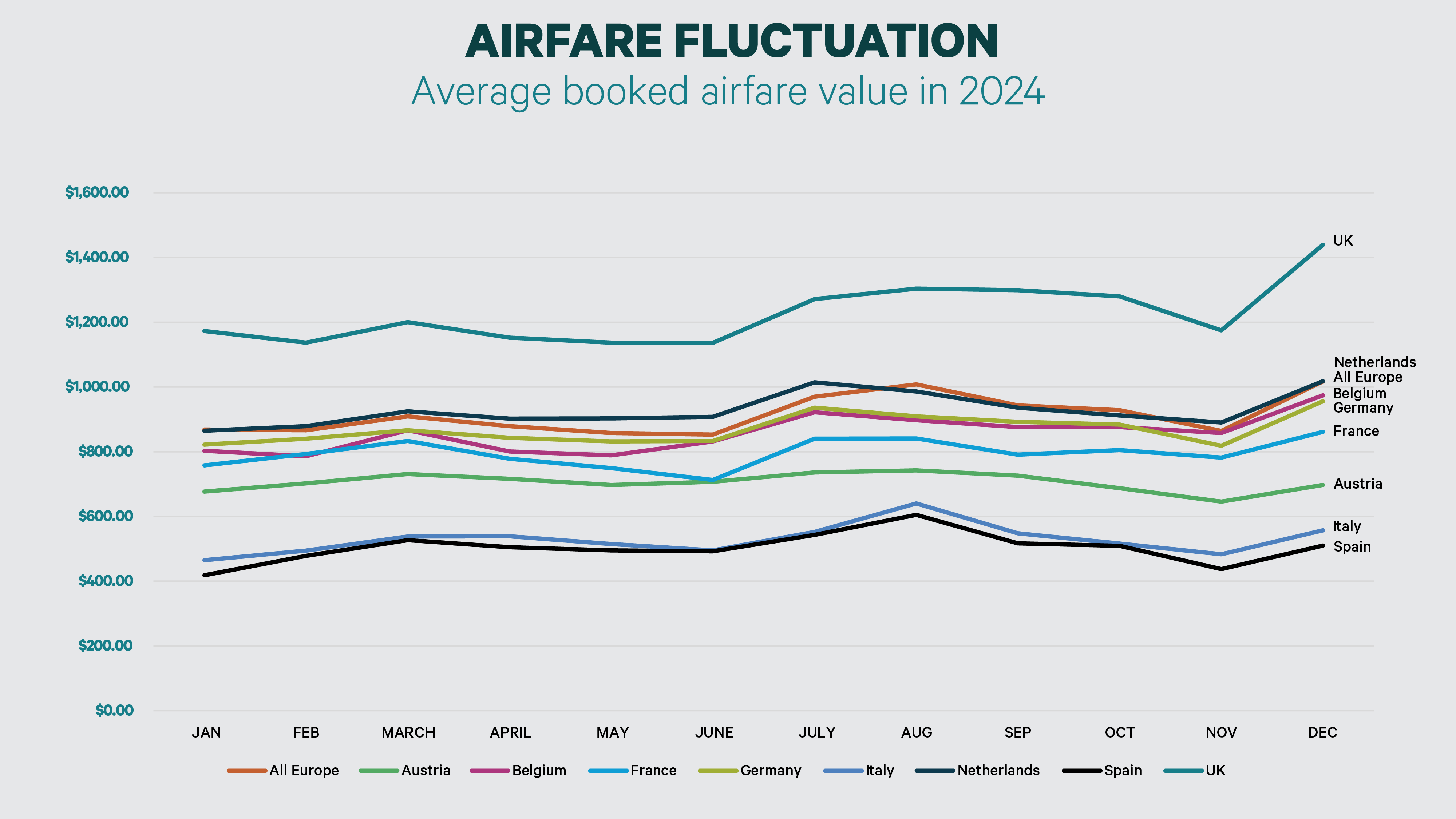

Volume movement

More data from Concur Travel reveals the year-on-year growth – or decline – in air travel volumes in 2024. For Europe as a whole, volumes were up year-on-year by double digits in January (+14 per cent), February (+17 per cent), April (+17 per cent), July (+13 per cent) and October (+10 per cent), but were flat or fell marginally in March (-2 per cent), June (-2 per cent), August (+1 per cent), November (+/-0 per cent) and December (+3 per cent). All eight markets got off to a strong start to the year, posting between 8 per cent (UK and France, January) and 28 per cent (Austria, February) year-on-year growth, before plateauing in March – attributable to the Easter period. Overall, monthly travel volumes in Austria increased the most versus 2023, with Belgium also performing strongly.

(Source: SAP Concur)

(Source: SAP Concur)

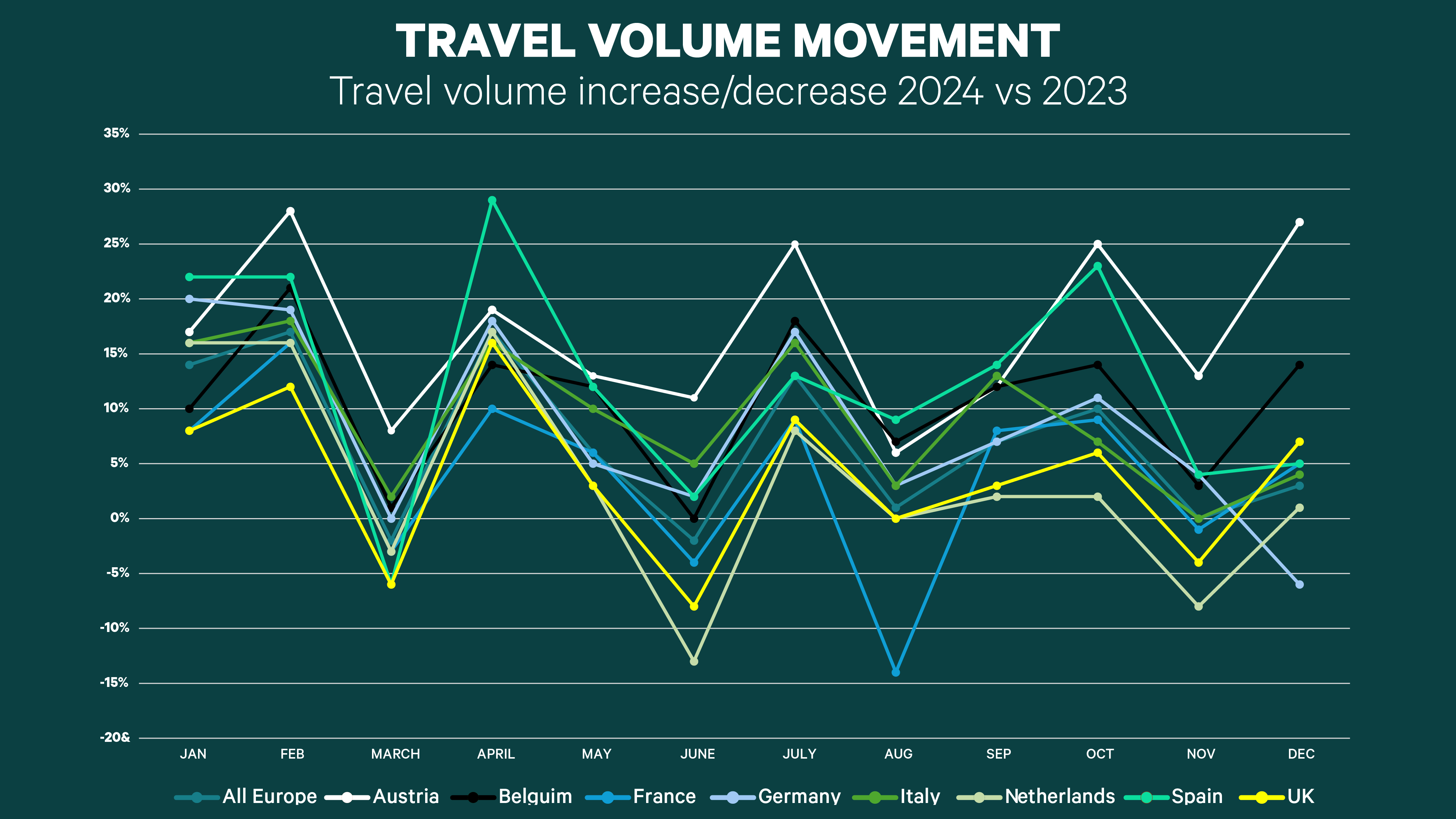

Coming to terms with NDC

Around three-quarters of European travel managers say their company has or is booking some NDC content. According to research carried out in early March by Business Travel Show Europe on behalf of Business Travel News Europe, more than two-thirds of corporates surveyed are accessing NDC fares via their TMC. One in five respondents (20 per cent) said their company is not booking NDC fares. The survey was fielded in early March and received 115 responses from travel managers based in Europe.

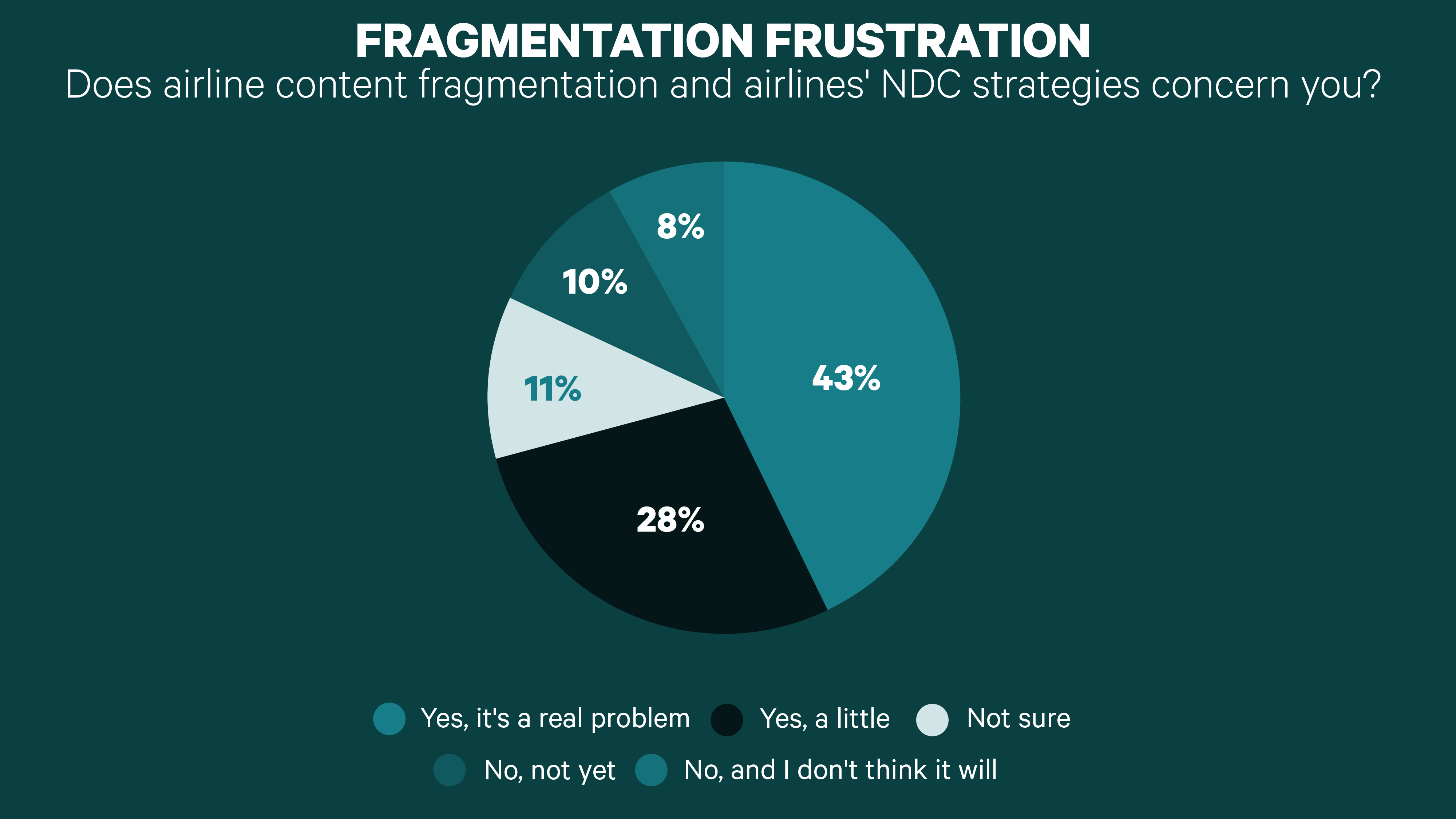

NDC content has been a long time coming, and although penetration is now creeping up, there are notable knock-on effects for buyers and their travel programmes. More than two-thirds (71 per cent) of European travel managers surveyed said they are concerned about airlines’ NDC strategies, while 11 per cent are unsure, and 18 per cent are unconcerned.

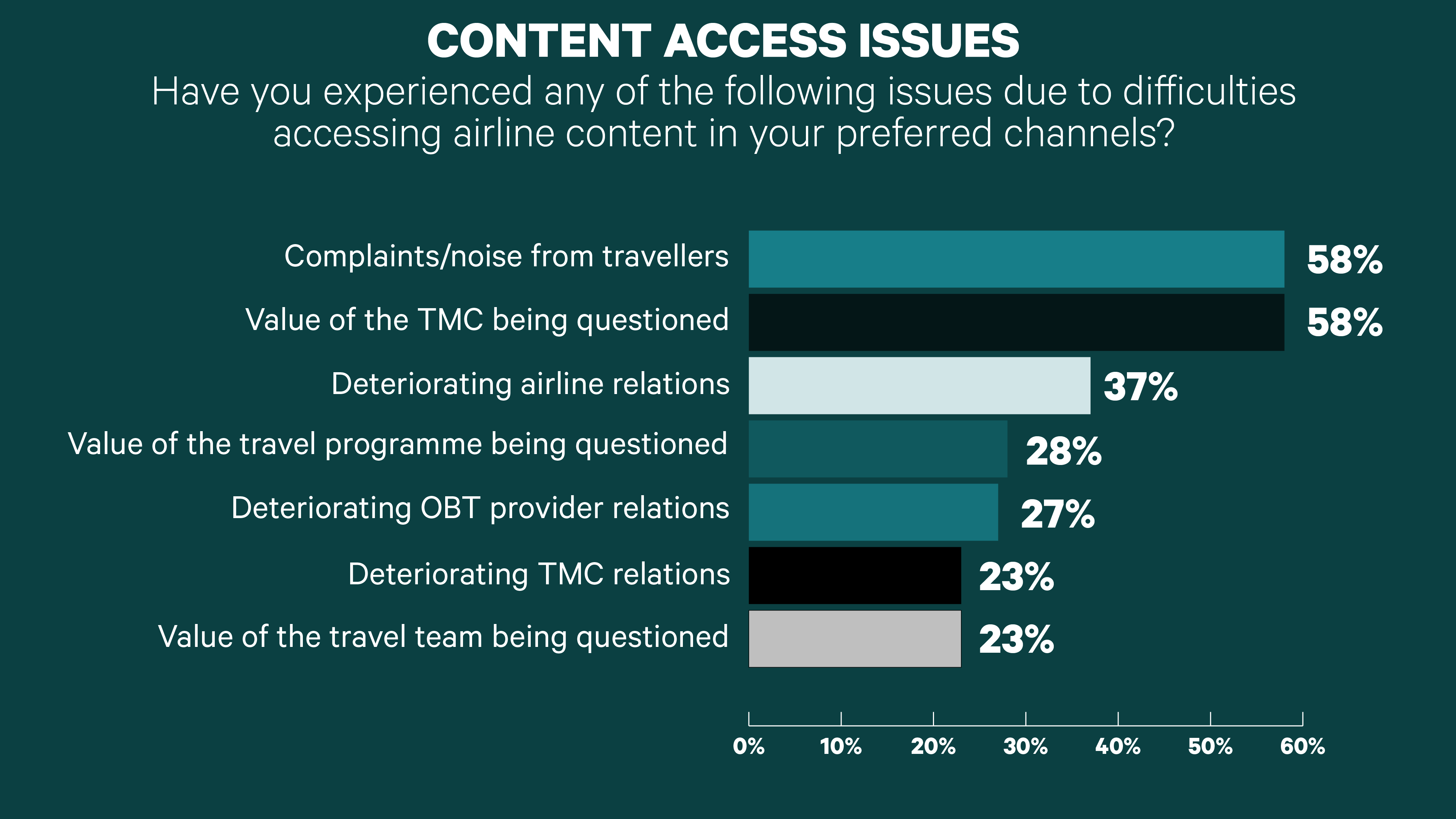

Of the travel managers surveyed, nearly 60 per cent reported complaints and noise from travellers due to difficulties accessing airline content in preferred channels, with a similar proportion (58 per cent) finding the value of a TMC being brought into question. More than a third of buyers (37 per cent) reported deteriorating relations with airlines.

(Respondents could select all options that apply)

(Respondents could select all options that apply)

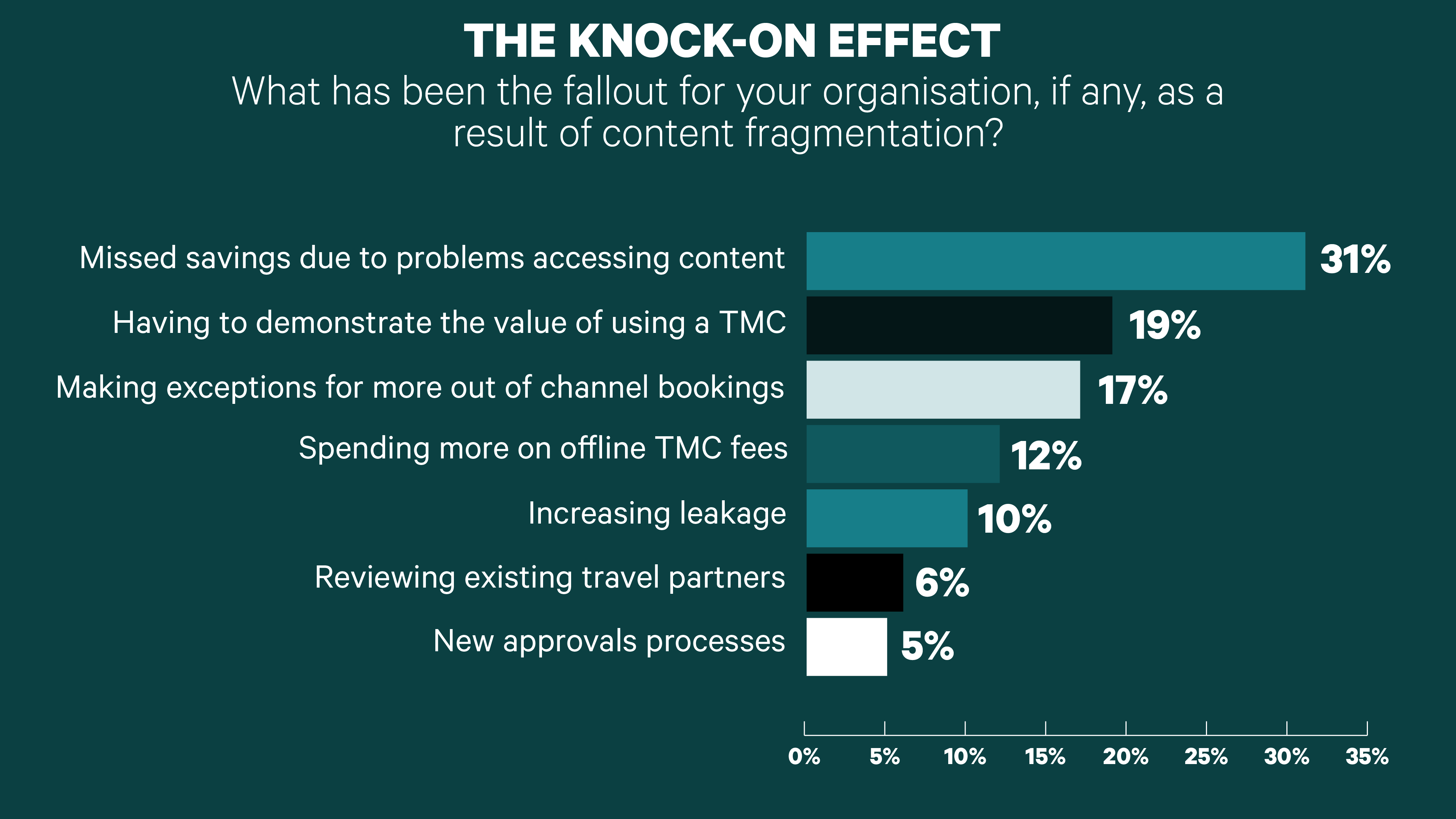

Meanwhile, three in ten travel managers (31 per cent) said their company missed savings opportunities due to being unable to access certain content, 19 per cent have found themselves having to demonstrate the value of a TMC, and 17 per cent have had to make more exceptions for bookings outside of preferred channels.

(Respondents could select all that apply)

(Respondents could select all that apply)

Going the distance

According to data from travel management company CTM, business travellers based in Singapore travel the furthest for work, clocking up an average of 4,319 miles on the road in 2024. Business travellers in Japan travelled the next farthest (4,188 miles), followed closely by Hong Kong (4,007 miles). Business travellers in 10 of the 12 markets detailed travelled more miles in 2024 than pre-Covid in 2019, with only workers in New Zealand and Hong Kong travelling fewer miles on average last year than in 2019.

(Source: CTM)

(Source: CTM)

Planning ahead

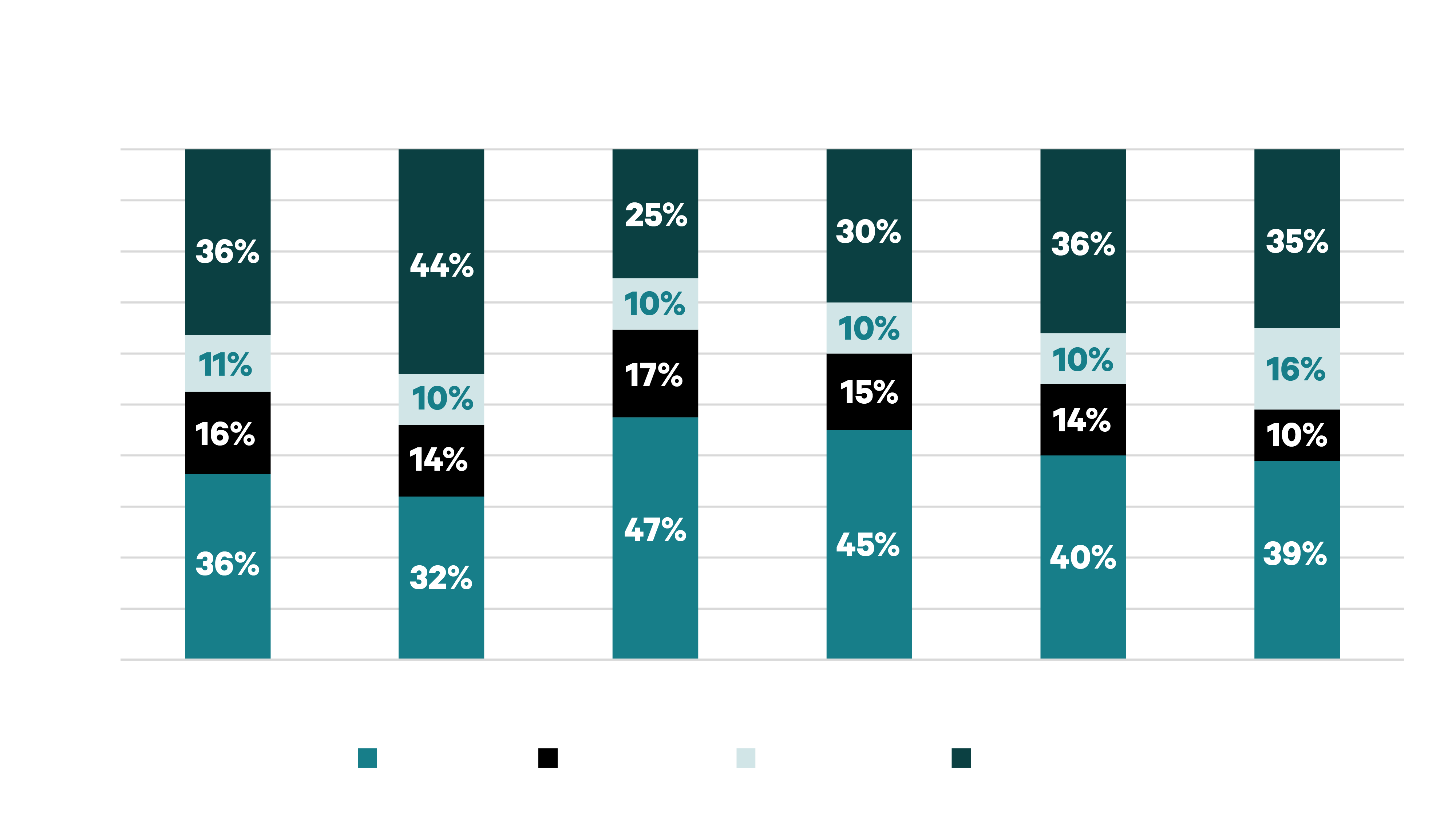

In 2024, around four in ten business travellers under CTM’s customerbase booked flights a week or less ahead of travelling. Ten per cent secured seats between eight and 14 days ahead of departure, 16 per cent booked between 15 and 21 days out, and the remaining 35 per cent booked more than 21 days ahead. Having seen a greater proportion of late bookings during the pandemic when constantly changing travel restrictions made advance booking difficult, 2024’s split was similar to that seen pre-Covid in 2019.

(Source: CTM)

(Source: CTM)

Amex GBT accelerates NDC adoption

According to documents submitted as part of inquiries into its acquisition of CWT, nearly 50 per cent of Amex GBT’s American Airlines transactions on its ‘owned channels’ – booking platforms Neo and Egencia – were at one stage NDC fares. The TMC told BTN Europe in March that “adoption rates remain high” even since the airline reversed its ill-fated distribution strategy.

Also in March, the TMC highlighted in a LinkedIn post that it had processed more than one million NDC tickets between January 2024 and February 2025 across 16 point-of-sale countries. The TMC told BTN Europe that more than 20 airlines “are part of the programme” and that it continues to expand pilots with third party platforms including Concur and Cytric. More than 15,000 clients have access to NDC fares, it added, and 97 per cent of US customers using Neo and Egencia have access to NDC content. Its top four airlines for NDC bookings are Air France-KLM, Finnair, American Airlines and Lufthansa Group.

Gray Dawes & Navan forge ahead

UK-based travel management company Gray Dawes has been vocal about its NDC adoption progress and is understood to be the largest booker of British Airways NDC content in the UK. The TMC noted that NDC numbers vary from month to month which is largely dependent on airline pricing. “For example, if there is a better value NDC fare, it gets sold. If not, then a GDS fare gets sold.”

It provided BTN Europe with its NDC adoption figures for four airlines in February 2025. The average saving displayed is the difference between the NDC average and non-NDC average fare booked and can be skewed by class of travel and high value transaction anomalies, it noted.

SWITCHED ON

Gray Dawes NDC bookings adoption (February 2025)

|

Adoption rate in February 2025 |

Average saving |

|

|

Lufthansa Group |

73% |

£155 |

|

British Airways |

65% |

£107 |

|

KLM |

48% |

£154 |

|

Air France |

40% |

£184 |

Looking further back, at 2024 as a whole, more than two-thirds (69 per cent) of Austrian Airlines bookings were NDC fares, with Swiss (62 per cent) and Brussels Airlines (59 per cent) the next highest proportions of NDC tickets. Slightly further back, 55 per cent of British Airways, Lufthansa and American Airlines bookings were on NDC.

A representative of the TMC said there are more airlines whose NDC content it could go live with, but it prefers to wait until the carrier’s NDC infrastructure is “rock solid” when it comes to post-ticket servicing. “The airlines we’re booking in Europe are the most advanced/mature, so [they] get booked and have something better for the client,” they added.

Travel management company Navan, meanwhile, told BTN Europe that by the beginning of this year 30 per cent of all flights booked globally on the platform were NDC, up from 24 per cent in May 2024. In Europe, the figure was slightly higher at 37 per cent at the start of the year, up from 31 per cent last May. It reported an average saving of 9.4 per cent on fares booked via its NDC connection versus those made via GDS.